photobatll.ru

Tools

Stable Gasoline Treatment

Americas #1 Fuel Stabilizer Treatment · Keeps fuel fresh for long term storage, up to 24 months · Eliminates the need to drain fuel prior to storage · Ensures. Gasoline can begin to degrade and oxidize a month after it is pumped. During oxidation, fuel molecules become less stable. As fuel oxidizes it can turn to gum. America's #1 Fuel Stabilizer Treatment; Keeps fuel fresh for long term storage – up to 24 months; Eliminates the need to drain fuel prior to storage. Use fuel treatment with demulsifying properties that separate water from fuel. Tanks available today are most likely equipped with a Fuel Water Separator (FWS). AMERICA'S #1 FUEL STABILIZER TREATMENT! STA-BIL® Storage Fuel Stabilizer keeps fuel fresh for quick and easy starts after storage. PRI-G is a fuel stabilizer that preserves stored fuels in fresh refinery condition for years. Also, it is a super concentrated, complete fuel treatment that. The fuel stabilizer will treat the fuel in the tank, which is a good thing, but it won't prevent condensation from diluting the gas and adding. Sta-Bil Storage Fuel Stabilizer Fuel Treatment: Keeps Fuel Fresh For Up To 12 Months During Storage, 10 oz. Part # 30 day replacement if defective. Usually non-ethanol blend gas with Stabil can be stored in a non-vented steel safety can for up to 2 years, if stored in a temperature and. Americas #1 Fuel Stabilizer Treatment · Keeps fuel fresh for long term storage, up to 24 months · Eliminates the need to drain fuel prior to storage · Ensures. Gasoline can begin to degrade and oxidize a month after it is pumped. During oxidation, fuel molecules become less stable. As fuel oxidizes it can turn to gum. America's #1 Fuel Stabilizer Treatment; Keeps fuel fresh for long term storage – up to 24 months; Eliminates the need to drain fuel prior to storage. Use fuel treatment with demulsifying properties that separate water from fuel. Tanks available today are most likely equipped with a Fuel Water Separator (FWS). AMERICA'S #1 FUEL STABILIZER TREATMENT! STA-BIL® Storage Fuel Stabilizer keeps fuel fresh for quick and easy starts after storage. PRI-G is a fuel stabilizer that preserves stored fuels in fresh refinery condition for years. Also, it is a super concentrated, complete fuel treatment that. The fuel stabilizer will treat the fuel in the tank, which is a good thing, but it won't prevent condensation from diluting the gas and adding. Sta-Bil Storage Fuel Stabilizer Fuel Treatment: Keeps Fuel Fresh For Up To 12 Months During Storage, 10 oz. Part # 30 day replacement if defective. Usually non-ethanol blend gas with Stabil can be stored in a non-vented steel safety can for up to 2 years, if stored in a temperature and.

It works well as a fuel additive for regular use and will stabilize gasoline for up to two years. You can even use it to treat two-cycle engines and. Star Tron Enzyme Fuel Treatment is a multi-functional fuel additive that uses enzyme technology to stabilize fuel and make engines run smoothly and. Fuel stabilizers: These additives help keep the fuel fresh and stable for longer. They are particularly useful for fuel stored for extended periods, such as. Safe To Use – PRI-G's enhanced thermal stability chemistry works within the fuel instead of altering it, which means the product is completely safe to use. Fuel. STA-BIL Storage Fuel Stabilizer keeps fuel fresh for quick and easy starts after storage. Alternatively, the additive works wonders to keep the gasoline of. Sta-Bil Fuel Treatment is a remarkable solution for preserving and enhancing the quality of gasoline, especially when it comes to fuel that sits for extended. Expert advice on how to prepare for an emergency by stock-piling gasoline to power your generator once the electricity is out. Hurricanes and storms cause. STA-BIL® Storage Fuel Stabilizer keeps fuel fresh for quick, easy starts after storage. It removes water to prevent corrosion, as well as cleaning carburetors. The fuel stabilizer will treat the fuel in the tank, which is a good thing, but it won't prevent condensation from diluting the gas and adding. It works well as a fuel additive for regular use and will stabilize gasoline for up to two years. You can even use it to treat two-cycle engines and. Our fuel stabilizers and treatments each contain a powerful mix of additives and chemicals that neutralize acids, prevent gasoline from oxidizing, and coat. The fuel stabilizer will treat the fuel in the tank, which is a good thing, but it won't prevent condensation from diluting the gas and adding. Treating your fuel with STA-BIL keeps it fresh for up to 12 months and stops the formation of gum and varnish deposits within the fuel system. It's because of the additives in gas. If gas is left in a carburetor I have a yard tractor and snow blower so i keep 20gal of fuel with stable. Our fuel stabilizers and treatments each contain a powerful mix of additives and chemicals that neutralize acids, prevent gasoline from oxidizing, and coat. Treat rate is 1oz to 2 ½ gallons of gas. If using with small engine equipment it is best to add STA-BIL Storage to your gas can. This way every piece of. Fuel Fit not only keeps the carburettor clean for easy starting but now also protects against the corrosive effects of ethanol and maintains fuel stability for. Super concentrated PRI-G gasoline treatment improves ignition quality, prevents engine deposits, protects against E phase separation, and restores. Fuel Fresh for 24 Months - Prevents Corrosion - Gasoline Treatment that Protects Fuel System - Fuel Saver - Treats 80 Gallons - 32 Fl. Oz. () at Amazon. Basically, it's an anti-expiry solution that will keep the gasoline fresh for longer than it would be otherwise. Most fuel stabilizer solutions will protect the.

Do I Need To Pay Taxes On Crypto Gains

If your bitcoin is on a centralized exchange, you're going to have to pay the taxes. The exchange is going to send a tax form to the IRS. Even. Capital gains from crypto trading need to be reported on Form and Schedule D, while crypto income needs to be reported in your income tax return (Form ). If you're holding crypto, there's no immediate gain or loss, so the crypto is not taxed. Tax is only incurred when you sell the asset, and you subsequently. If your crypto suffered a loss, you wouldn't need to pay taxes upon selling or spending it. Let's circle back to our example earlier. To illustrate: If your. Depending on your circumstances, you may have to pay Capital Gains Tax or Income Tax for cryptocurrency transactions. Income Tax, Capital Gains Tax. Mining. In most countries, including the United States, you are required to pay taxes on any gains you make from cryptocurrency, regardless of whether. The Canada Revenue Agency (CRA) taxes most cryptocurrency transactions. Canadians do not have to pay taxes for buying or holding cryptocurrency. Do you have to pay taxes on crypto? According to Notice Opens in a new window, the IRS currently considers cryptocurrencies "property" rather than. file them, at least for the first time. Do I Have to Pay Taxes on Cryptocurrency? Yes. The type of taxes you pay and how much depends on the circumstances. If your bitcoin is on a centralized exchange, you're going to have to pay the taxes. The exchange is going to send a tax form to the IRS. Even. Capital gains from crypto trading need to be reported on Form and Schedule D, while crypto income needs to be reported in your income tax return (Form ). If you're holding crypto, there's no immediate gain or loss, so the crypto is not taxed. Tax is only incurred when you sell the asset, and you subsequently. If your crypto suffered a loss, you wouldn't need to pay taxes upon selling or spending it. Let's circle back to our example earlier. To illustrate: If your. Depending on your circumstances, you may have to pay Capital Gains Tax or Income Tax for cryptocurrency transactions. Income Tax, Capital Gains Tax. Mining. In most countries, including the United States, you are required to pay taxes on any gains you make from cryptocurrency, regardless of whether. The Canada Revenue Agency (CRA) taxes most cryptocurrency transactions. Canadians do not have to pay taxes for buying or holding cryptocurrency. Do you have to pay taxes on crypto? According to Notice Opens in a new window, the IRS currently considers cryptocurrencies "property" rather than. file them, at least for the first time. Do I Have to Pay Taxes on Cryptocurrency? Yes. The type of taxes you pay and how much depends on the circumstances.

Washington does not tax the purchase of cryptocurrency, such as Bitcoin, and treats purchases of taxable goods or services made with cryptocurrency as taxable. You'll only pay tax on crypto gains, so whenever you've made a profit. In addition to this, HMRC has finally released some guidance on DeFi transactions - in. That change in the value of the underlying cryptocurrency is a capital gain or capital loss for US tax purposes and needs to be reported on the annual Federal. Because many people might not know that, they could fail to report their crypto gains appropriately. Even if you know that you still have to pay taxes, you. When you buy crypto with fiat currency, hold it, move it between your own digital wallets, or are gifted it, you don't have to pay taxes. We know, it's not a. Crypto trading is taxed at a capital gains level, where you have to determine the gain/loss on each trade and pay the appropriate tax rate between a short-term. You will pay short-term capital gains tax rates on exchanges of crypto assets you have owned for less than a year. You pay higher tax rates on short-term. Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax bill. TABLE OF CONTENTS. Do I have to pay crypto taxes? While you do have to pay taxes on personal income, capital gains and business income from crypto, there is a short list of transactions that will not incur a. Similar to payments received by traditional payment methods, any crypto payments for taxable goods or services need to be reported as income. Sweepstakes. Do I have to pay tax on cryptocurrency? Minu Plus. Yes. Cryptocurrency is subject to capital gains and income tax. Tax evasion is punishable by a fine of up. This is considered a taxable event, even if you do not cash out to fiat currency. What you reinvest in isn't even relevant, but rather the gains or losses you. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. We are updating the Crypto experience related to Total Gain and Total Return. Please ensure that your app is up to date as we continue this rollout. Tax. Ultimately, if your losses exceed your gains for the year, you could deduct up to $3, from your yearly taxable income. Did you know? For the tax. This means that you don't need to pay taxes on gains made while holding crypto. However, anytime you either sell, trade, exchange, convert, or buy items. Crypto is treated as property, subject to capital gains and income tax. How do I pay taxes on crypto? Report capital gains or losses on your tax.

Are 401k Contributions Taxable

If you have a (k) plan, contributions you make for yourself (including your employer contribution) are deductible on line 28 of your Form (excluding. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. Earnings on after-tax contributions are considered pre-tax and would grow tax-deferred until withdrawals begin. Employee contributions to Roth (k)s are made with after-tax income: There is no tax deduction in the contribution year, but withdrawals are tax-free. If you. Both you and your employees can make pre-tax (k) contributions to a traditional (k) account. This means your workers will pay taxes at a later date. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and (k) contributions. 2. For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and. Depending on your income, you may be able to deduct any IRA contributions on your tax return. Like a (k) or (b), monies in IRAs will grow tax deferred—and. The real power of after tax k contributions arises when your plan also allows in-plan Roth conversions or in-service withdrawals that allow. If you have a (k) plan, contributions you make for yourself (including your employer contribution) are deductible on line 28 of your Form (excluding. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. Earnings on after-tax contributions are considered pre-tax and would grow tax-deferred until withdrawals begin. Employee contributions to Roth (k)s are made with after-tax income: There is no tax deduction in the contribution year, but withdrawals are tax-free. If you. Both you and your employees can make pre-tax (k) contributions to a traditional (k) account. This means your workers will pay taxes at a later date. Pre-tax deductions include employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and (k) contributions. 2. For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and. Depending on your income, you may be able to deduct any IRA contributions on your tax return. Like a (k) or (b), monies in IRAs will grow tax deferred—and. The real power of after tax k contributions arises when your plan also allows in-plan Roth conversions or in-service withdrawals that allow.

It provides two important advantages. First, all contributions and earnings are tax deferred. You only pay taxes on contributions and earnings when the money is. Finally, (k) assets are subject to required minimum distributions at age For investors who expect to be in a high tax bracket upon retirement, having. Therefore, your distributions are usually taxable. A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account. Traditional (k)s use pre-tax dollars -- that is, your contributions reduce your taxable income for the year and you pay taxes on your withdrawals later. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. ES Tax FAQs. Are (k) deductions reportable? No. A (k) is an IRS qualified retirement plan, and therefore, meets our. If your plan allows for after-tax contributions, you can save beyond the pre-tax annual contributions limits—and still have your contributions grow tax-free. The answer is: Not exactly. You don't deduct (k) contributions from your tax obligation. Instead, your taxable salary is reduced by the amount of the. The percentage of your annual (k) contributions your employer will match. These contributions are often capped. Please read the definition for "Employer. As a result, the expenses you pay for the plan may be deductible. That includes contributions that you make to employees, as well as any administrative costs. However, you don't actually take a tax deduction on your income tax return for your (k) plan contributions. This is because you receive the benefit of a tax. Employee contributions to a (k) plan and any earnings from the investments are tax-deferred. You pay the taxes on contributions and earnings when the savings. After-tax contributions to a (k) plan are similar to Roth contributions in that they're made with after-tax dollars, and don't reduce your taxable income in. Employee contributions to Roth (k)s are made with after-tax income: There is no tax deduction in the contribution year, but withdrawals are tax-free. If you. Many small business owners are surprised to learn that they can deduct employer contributions to the plan, up to 25 percent of total participant compensation. The benefit of a Roth (k) over a traditional (k) after retirement is distributions are tax-free, but some distributions can be taxed. That means, you don't pay taxes on the amount you contribute in a given year. Instead, you pay taxes when you withdraw the funds. What is a Roth (k)?. The. An after-tax (k) contribution is just that — made after taxes are paid. Like a Roth (k), earnings grow tax-deferred. Unlike the federal income tax law, contributions to a (K) or contributions to other types of retirement plans are considered part of the employee's taxable. 62, § 2(d)(1)(D), partners and other self-employed individuals are denied any deduction for contributions to their (k) plans, irrespective of whether the.

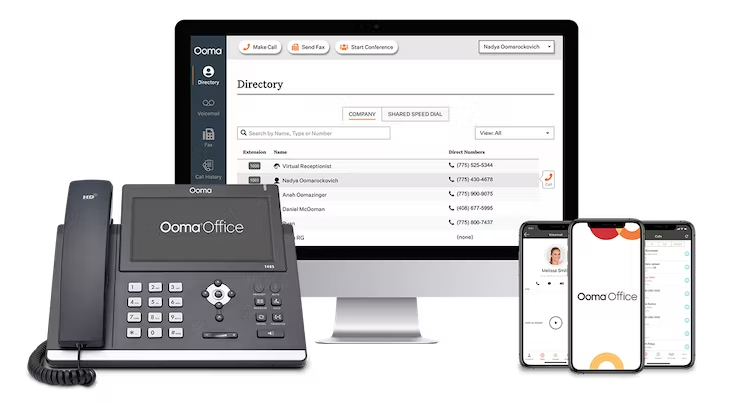

Best Voip Service

Ooma is known for offering affordable VoIP phone service for residential homes. They have a free basic plan, which already comes with unlimited US calls. We've compiled an extensive list of the leading business VoIP phone service providers on the market. If you're looking to compare business VoIP providers on. Detailed look at 12 of the top VoIP providers for your home · 1. Ooma · 2. 1-VoIP · 3. AXvoice · 4. Callcentric · 5. Google Voice · 6. magicJack · 7. PhonePower. photobatll.ru is a customer-oriented Cloud PBX and SIP Trunk VoIP service provider offering competitive prices on a Pay-as-You-Go model. A business Voice over Internet Protocol (VoIP) system is an efficient, simple and affordable communications option that can help keep your growing business. Nextiva · Business VoIP Solutions for SMBs and Enterprise · Office Plans Starting at $20 per User per Month · Unlimited Calling and Virtual Faxing. View Profile. Best VoIP phone services · Google Voice: Best for new users. · Dialpad: Most advanced AI integrations. · Intermedia Unite: Best traditional on-premise provider. RingCentral is the industry-leading provider of VoIP services · Made for business · Easy and simple telephony setup · Mobile and flexible VoIP system · No telephony. 10 best residential VoIP providers that offer great value for money · 1. AXvoice · 2. VoIPo · 3. PhonePower · 4. ViaTalk · 5. 1-VoIP · 6. Ooma Telo · 7. eVoice. Ooma is known for offering affordable VoIP phone service for residential homes. They have a free basic plan, which already comes with unlimited US calls. We've compiled an extensive list of the leading business VoIP phone service providers on the market. If you're looking to compare business VoIP providers on. Detailed look at 12 of the top VoIP providers for your home · 1. Ooma · 2. 1-VoIP · 3. AXvoice · 4. Callcentric · 5. Google Voice · 6. magicJack · 7. PhonePower. photobatll.ru is a customer-oriented Cloud PBX and SIP Trunk VoIP service provider offering competitive prices on a Pay-as-You-Go model. A business Voice over Internet Protocol (VoIP) system is an efficient, simple and affordable communications option that can help keep your growing business. Nextiva · Business VoIP Solutions for SMBs and Enterprise · Office Plans Starting at $20 per User per Month · Unlimited Calling and Virtual Faxing. View Profile. Best VoIP phone services · Google Voice: Best for new users. · Dialpad: Most advanced AI integrations. · Intermedia Unite: Best traditional on-premise provider. RingCentral is the industry-leading provider of VoIP services · Made for business · Easy and simple telephony setup · Mobile and flexible VoIP system · No telephony. 10 best residential VoIP providers that offer great value for money · 1. AXvoice · 2. VoIPo · 3. PhonePower · 4. ViaTalk · 5. 1-VoIP · 6. Ooma Telo · 7. eVoice.

Business owners rate Nextiva as the best VoIP provider for our exceptional support. Period. Is VoIP Worth the Hype? As a small business owner, you've likely. GetVoIP is an advertising-supported publisher and comparison service. We are compensated as follows: In exchange for featured placement of sponsored products. At Telenet Solutions we aim to provide the best of the services with respect to VOIP and other communication systems. We have tie-ups with leading communication. VoIP Office integrates seamlessly with most business-critical apps and services, such as Salesforce, SugarCRM, Zendesk, ZOHO, MS Dynamics, and many more. Starting at $ per month with an annual plan, AXvoice is one of the best bang-for-your-buck residential VoIP providers we've encountered. The service bundles. Our integrated voice solution syncs with all other customer service channels & lets agents see all customer information right away. Nextiva, RingCentral, and Vonage are frequently ranked as the best VoIP providers. Each caters to a different set of requirements: Nextiva is. Find the best residential VoIP providers for your home phone service needs. Access thousands of user reviews and find the lowest price for Home VoIP. Mobile VoIP apps: Various VoIP providers like RingCentral provide iPhone, Android and Blackberry apps, which assist with managing your VoIP network even while. Unlimited business VoIP phone calls nationwide, text messaging, conferencing, and team chat from $/mo. See why over a million people use Nextiva. Business VoIP phone services are hosted online and users access them through an app on their internet-connected desktop or mobile device. GetVoIP is an advertising-supported publisher and comparison service. We are compensated as follows: In exchange for featured placement of sponsored products. You can also make VoIP calls for free. Obviously, Skype is the most famous of the free VoIP calling services. But other VoIP services, such as CallCentric. Top VoIP Service Providers · AVOXI · RingCentral · Nextiva · CallHippo · Dialpad · 8x8. Top VoIP Providers. Choose the right VoIP Providers using real-time, up-to-date product reviews from verified user reviews. Our enterprise-grade cloud-based platform comes packed with the best and most useful business phone features like auto-attendant, voicemail transcription, and. The best VoIP service for small business. After trying several options OnSIP was by far the best. VoIP has many technical quirks and they've succeeded in making. GoTo Connect is one of the best international VoIP providers that allow businesses to make calls, send text messages, and attend virtual meetings from anywhere. We've compiled this free comparison guide to help you compare and identify the best business VoIP service providers for your specific needs.

How To Settle Bodily Injury Claim

Is there a time limit for insurance claim settlements? Generally, the insurance company has about 30 days to investigate your auto insurance claim, though the. Lump-sum payments and structured settlements are the two most common ways personal injury settlements are paid. A lump-sum payment means you get all your. 1. Obtain medical care. · 2. Prepare documentation. · 3. Consider a legal consultation. · 4. Investigate the accident and injuries. · 5. Establish negligence. · 6. Tip #1: Determine a minimum settlement number. In the early stages of your negotiations, you'll likely need to write and send a demand letter. · Tip #2: Don't. If you and the adjuster can negotiate an acceptable settlement, put the agreement in writing. You'll eventually have to sign a release saying you give up your. Essentially, settling any kind of claim involves releasing your rights to further pursue the claim in exchange for payment of a sum of money. 1. Preserve Evidence · 2. Get Medical Treatment · 3. Value Your Claim Fully · 4. Don't Be Too Eager · 5. Explain Why the Offer Is Inadequate · 6. Don't Forget Future. Steps in the Auto Accident Settlement Process · File a Formal Insurance Claim · Cooperate with the Insurer's Investigation · Perform an Independent Investigation. Evaluate the extent of your damages · Speak to the insurance adjuster · Craft your demand letter · Do your due diligence before going to court · Await the judge's. Is there a time limit for insurance claim settlements? Generally, the insurance company has about 30 days to investigate your auto insurance claim, though the. Lump-sum payments and structured settlements are the two most common ways personal injury settlements are paid. A lump-sum payment means you get all your. 1. Obtain medical care. · 2. Prepare documentation. · 3. Consider a legal consultation. · 4. Investigate the accident and injuries. · 5. Establish negligence. · 6. Tip #1: Determine a minimum settlement number. In the early stages of your negotiations, you'll likely need to write and send a demand letter. · Tip #2: Don't. If you and the adjuster can negotiate an acceptable settlement, put the agreement in writing. You'll eventually have to sign a release saying you give up your. Essentially, settling any kind of claim involves releasing your rights to further pursue the claim in exchange for payment of a sum of money. 1. Preserve Evidence · 2. Get Medical Treatment · 3. Value Your Claim Fully · 4. Don't Be Too Eager · 5. Explain Why the Offer Is Inadequate · 6. Don't Forget Future. Steps in the Auto Accident Settlement Process · File a Formal Insurance Claim · Cooperate with the Insurer's Investigation · Perform an Independent Investigation. Evaluate the extent of your damages · Speak to the insurance adjuster · Craft your demand letter · Do your due diligence before going to court · Await the judge's.

Fortunately, it's fairly simple to negotiate a settlement for vehicle damages. The insurance company will want quotes for repair work, or an appraisal of the. Therefore, it's important to consult with a personal injury lawyer to discuss settlement process that involves residual pain and medical care in order to. Most auto- accident settlement claims are eventually settled outside of the courtroom — only a small percentage of car accident settlement cases are ever. If you cannot reach a car accident insurance settlement through negotiation, a lawsuit and an appearance in court may be required as well. Your claim could be. This guide explains what to expect from personal injury settlements and why the vast majority of cases are settled. Settling a Personal Injury Claim with an Insurance Company · Step 1: Gather Information Needed For Your Claim · Step 2: File Your Personal Injury Claim · Step 3. Our personal injury lawyers dig to determine the average bodily injury settlement and how to apply these statistical averages to calculate the range of payouts. The amount you can receive in a settlement varies depending on the severity of your injuries, but there are some factors that will influence the offer made by. Broadly speaking, a personal injury claim can take anywhere from a few months to several years. A quick settlement could be resolved within a few months, while. Having an experienced attorney on your side can help level the playing field when negotiating with insurance companies and their attorneys. Your lawyer can. Keep your EOB's from health insurance and any receipts from out of pocket expenses and submit a “demand letter” (google personal injury demand. Most lawyers will ask for 33% (one-third) of your settlement, but you can negotiate. If you've got an excellent case—liability is clear, your damages are. All costs to prepare the case for settlement, mediation or trial are typically advanced by the attorney (unless otherwise specified) until a recovery is. A skilled lawyer can negotiate a favorable out-of-court settlement of your claim that gets you paid the money you deserve. Most car accident cases don't go to trial. These claims are typically resolved out of court by car insurance companies and their insurance adjusters. Even if a. Los Angeles car accident attorney Sherwin Arzani break down the process of filing a claim with an insurance company and explain how you can maximize your. You may reach a settlement agreement with an insurer before that time. If you try to file a lawsuit after two years, though, it will be dismissed. Generally. The demand letter will need to outline why the insurance carrier is liable for the injuries, the extent of your injuries, the medical treatment you received. All that being said, insurance companies no longer pay anything near 3 times medical as a general guideline to settle personal injury claims. Now, the adjuster. As for a timeline for a car accident settlement process, you can expect anywhere between a few months to several years depending on the case and how much time.

Calculate Monthly Interest On Home Loan

Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Use this calculator to determine the Annual Percentage Rate (APR) for your mortgage. Press the report button for a full amortization schedule, either by year or. This calculator determines your mortgage payment and provides you with a mortgage payment schedule. The calculator also shows how much money and how many years. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Loan term (years). Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. This calculator will help you estimate a monthly payment, and understand the amount of interest you will pay regarding your home loan. To calculate simple interest, multiply the principal by the interest rate and then multiply by the loan term. · Divide the principal by the months in the loan. Use this calculator to determine the Annual Percentage Rate (APR) for your mortgage. Press the report button for a full amortization schedule, either by year or. This calculator determines your mortgage payment and provides you with a mortgage payment schedule. The calculator also shows how much money and how many years. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Loan term (years). Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans.

Use Investopedia's mortgage calculator to see how different inputs for the home price, down payment, loan terms, and interest rate would change your monthly. Detailed Calculations ; ₹ EMI ; ₹ 4,, Total interest payable over the loan term ; ₹ 11,, Total payments made over the loan term. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. How is interest calculated on my home loan? · Each day, we multiply your loan balance by your interest rate, and divide this by days (even in leap years). A mortgage amortization schedule is a table that lists each monthly payment from the time you start repaying the loan until the loan matures, or is paid off. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. A mortgage or home loan calculator is a digital tool that estimates your monthly payment and the terms of your mortgage. The calculator offers personalized. Calculate the interest over the life of the loan. Add 1 to the interest rate, then take that to the power of Subtract 1 and multiply by It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. Mortgage Calculator ; Purchase Price · Down Payment. $ ; Term · Interest Rate. % ; Property Tax · PMI. % ; Property Insurance · Start Date. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Illustration: How is EMI on Loan Calculated? ; Formula for EMI Calculation is - ; P x R x (1+R)^N / [(1+R)^N-1] where- ; P = Principal loan amount ; N = Loan tenure. The most significant factor affecting your monthly mortgage payment is the interest rate. If you buy a home with a loan for $, at percent your. Mortgage calculators are automated tools that enable users to determine the financial implications of changes in one or more variables in a mortgage. How to use the Home Loan EMI Calculator · Input loan amount: Start by entering the loan amount you're aiming for. · Set interest rate: Input the competitive. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. A portion of your monthly mortgage payment will pay down this balance. Interest:This is an additional percentage added to your principal that lenders charge you. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay. Use our Home Loan Calculator to get insights on your loan plan! Just select an amount, set an approximate interest rate and loan tenure. The Home Loan EMI. Calculate your monthly home loan payments, estimate how much interest you'll pay over time, and understand the cost of your mortgage insurance, taxes.